Welcome back to TJ’s Innovation Zone 💡

TJ’s Innovation Zone delivers punchy, field-tested tactics to founders and innovation leads every week. Actionable playbooks, case-study debriefs, and straight-talk on emerging tech—no fluff.

Subscribe and Join 190+ Innovation Leaders that already get innovation stories and practical business tips in their inbox, every week.

The air mobility sector has been attracting massive attention in recent years.

It's groundbreaking. It's sexy. It's innovative.

Everyone realizes it's the future of the transportation industry.

But the road to get there?

It’s quite bumpy.

This sector produced is known for huge investments, but also spectacular failures.

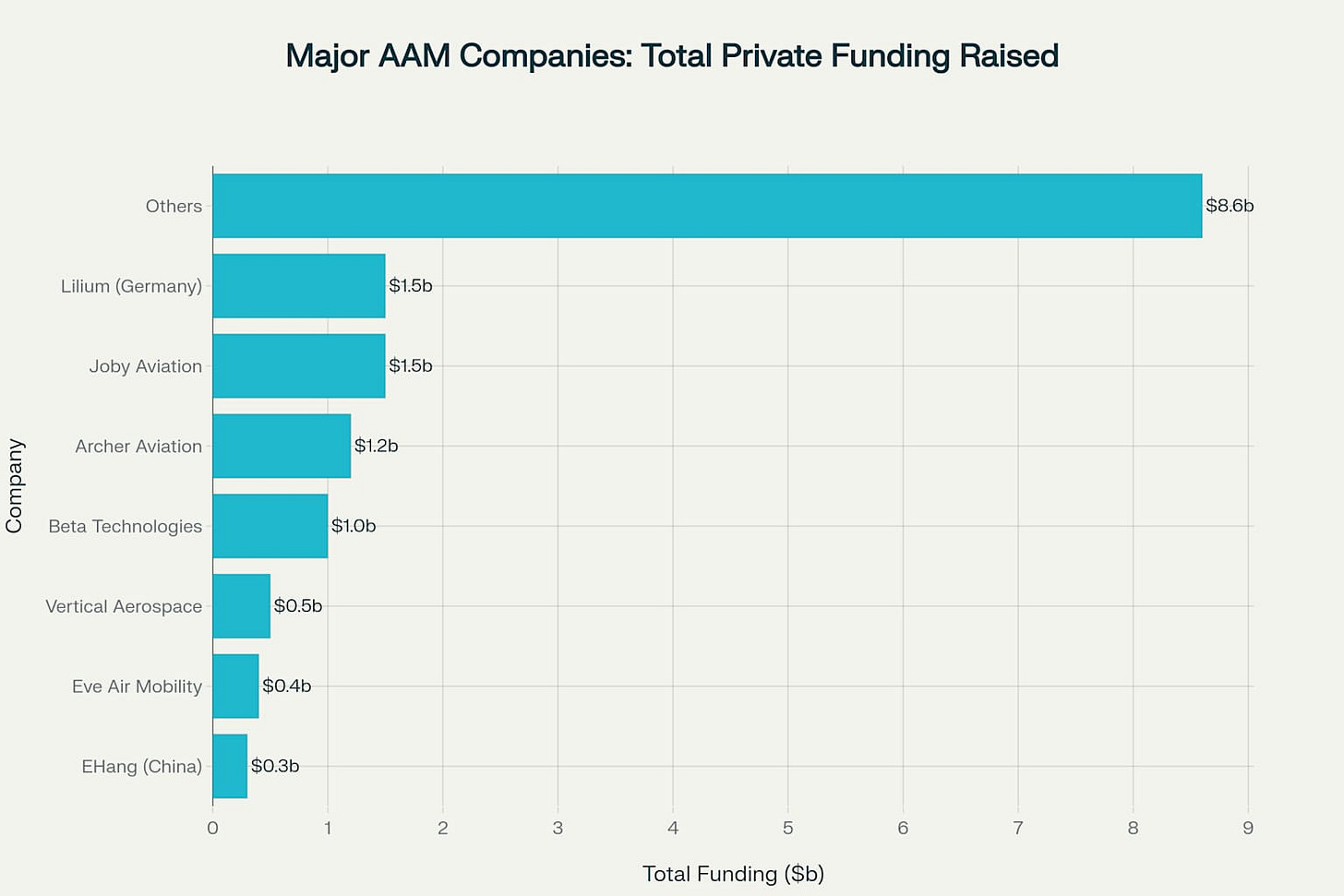

Fact is that despite attracting $20.8 billion in private investment from 2020-2024, the eVTOL industry is full of collapsed dreams and burned cash. Startups with billion-dollar valuations have crumbled. Promising technologies have hit insurmountable walls. Plenty of investors have watched their bets evaporate.

But among all these failures, one stands out in particularly.

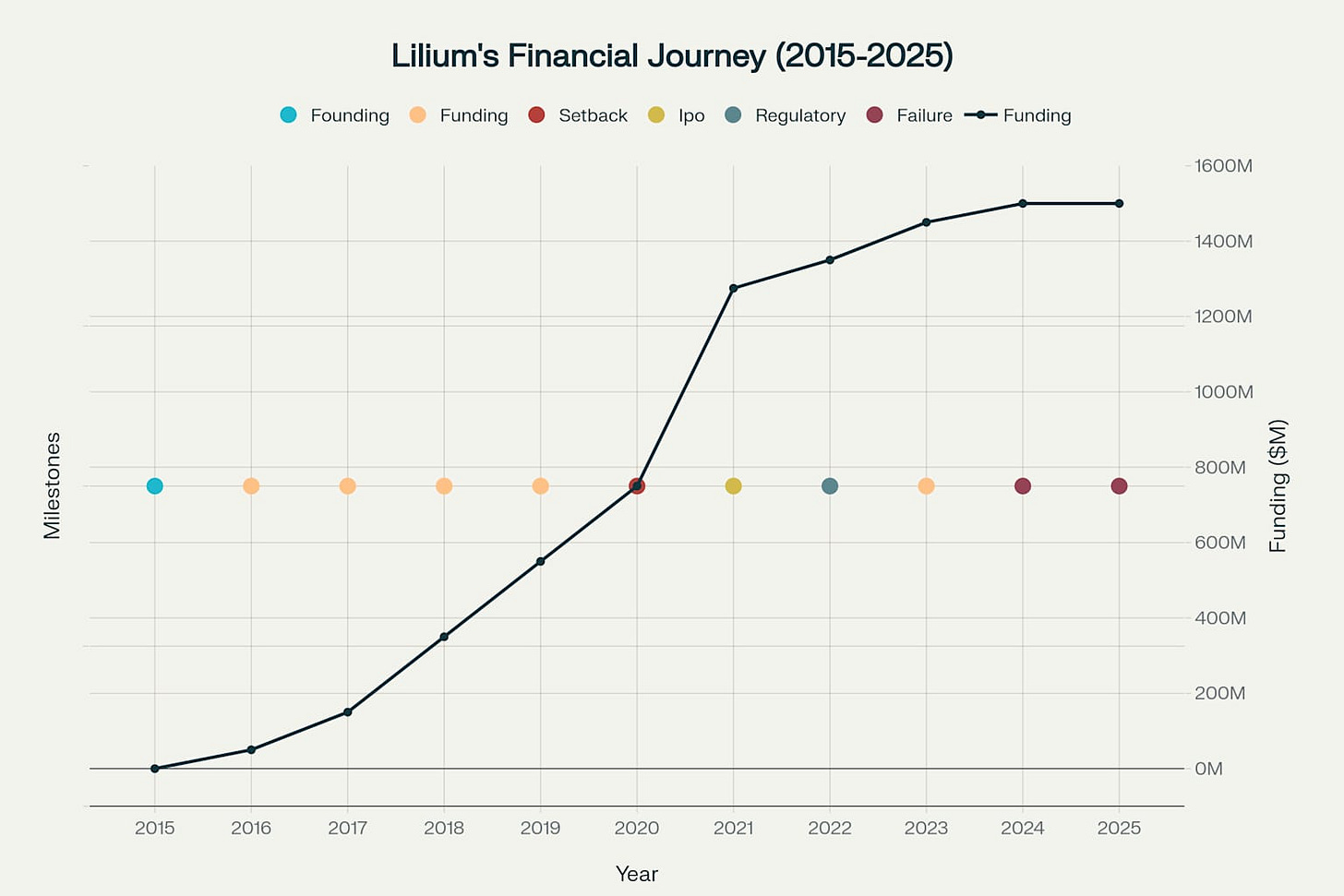

This post is about the grand failure of Lilium, once a $3.3B German startup, and now a reminder of how tough the AAM industry is.

What went wrong? And what can founders learn from aviation's most expensive lessons?

Let's dive in.

$20.8 Billion Over Four Years

The Advanced Air Mobility sector has attracted substantial private investment totaling $20.8 billion from 2020-2024, demonstrating strong investor confidence despite recent market corrections.

This represents a dramatic evolution from pre-COVID baseline levels, with funding peaking during the 2021 SPAC boom before stabilizing at elevated levels.

After reaching the 2021 peak, the sector experienced a 42.6% decline from peak levels. McKinsey analysis shows total deal value dropped to $3.9 billion in 2023, with 2024 expected to maintain similar levels.

This decline reflects broader venture capital market corrections and increased investor scrutiny of business models.

The $3.3 Billion Engineering Gamble

Lilium started exactly like every great tech story should.

Four PhD students and engineers in 2015 with a bold vision disrupt urban mobility through all-electric aircraft capable of vertical take-off and landing.

Their approach was distinctly German - methodical, engineering-focused, and ambitious.

While competitors built aircraft with 6-8 large open rotors, Lilium chose 36 small ducted fans distributed across the wings.

They were the first to try it, that was their huge differentiator.... and investors bought it.

The design promised:

Sleek, jet-like aesthetics

Reduced noise in forward flight

Enhanced safety through redundancy

Speeds up to 100 km/h in urban environments

Investors loved it.

The technology looked cutting-edge.

The team had serious engineering credentials.

What could go wrong?

How to Burn $400 Million Per Year

Here's where the story gets interesting.

Lilium appeared to be a fundraising superstar.

Over $1 billion raised before going public!!

Later, they added $525 million after NASDAQ debut in 2021.

The company peaked at a $3.3 billion valuation.

They even had orders for 100 jets from Saudia Arabia.

But underneath the impressive headlines, a financial disaster was brewing.

The numbers were staggering:

$400 million annual burn rate by 2024

€10 million monthly operating expenses

$187-198 million projected cash spend for first half of 2024 alone

That's not sustainable growth.

That's financial disaster.

While investors were writing checks, the core technology was consuming cash faster than the company could raise it.

When Physics Fights Back

Remember those 36 ducted fans that made the aircraft look so futuristic?

Well...apparently, they required twice as much power during hover compared to competitors with larger open rotors.

Reality hits hard when you try to bend it.

The physics were unforgiving:

High disc loading: 10 times higher than open propeller designs

Reduced range: Higher power requirements killed battery life

Increased weight: More powerful systems meant heavier components

Noise issues: The aircraft was louder than expected during testing

The first real hiccup occurred in February 2020 when their first prototype caught fire during ground maintenance. Not exactly the kind of publicity that builds investor confidence.

But the fire wasn’t the problem, it was the results.

The problem was the fundamental design choice that prioritized aesthetics over efficiency.

You see, Lilium chose 36 small ducted fans instead of 6-8 large open rotors. This looked futuristic but created massive engineering challenges.

Because the ducted fans needed twice as much power, Lilium had to build:

More powerful electrical systems

Larger battery packs

Complex power distribution networks

Advanced cooling systems to handle the heat

Higher power requirements created:

More electrical current flowing through systems

Higher operating temperatures

More stress on components

Greater thermal management challenges

More points where electrical failures could occur

The result - During ground maintenance at Oberpfaffenhofen Airfield, the first prototype caught fire. While the exact cause wasn't publicly detailed, the incident highlighted the risks of Lilium's complex power system.

Stuck in Certification Hell

Their decision to go with the ducted fans wasn’t just a tech problem.

While competitors like Joby progressed to stage 4 of the certification process, Lilium remained stuck at stage 2.

Why?

Their novel ducted fan design created additional regulatory complexity. Every innovation required more extensive testing and validation. More testing meant more time. More time meant more cash burn.

The certification process became a race against their bank account...

Unfortunately, they lost.

The Failed Government Bailout

The final financial blow came when Lilium failed to secure a crucial €50 million emergency loan guarantee from the German federal government. Bavaria had agreed to provide €50 million, but only on condition that the federal government matched this amount.

When the German parliament's budget committee blocked the federal guarantee, Lilium's financial lifeline was severed.

Four Hard Truths for Deep-Tech Founders

Lilium's failure offers crucial insights for any founder tackling deep-tech challenges:

Physics beats marketing every time

Cash management is survival

Regulatory risk is real risk

Government bailouts are not something to count on

The Choice Every Founder Faces

Every entrepreneur faces the same fundamental choice Lilium's founders made: innovate for genuine advantage or innovate for the sake of being different.

The market doesn't care how cool your technology looks. It cares whether it works, whether it can be built sustainably, and whether customers will pay for it.

Before your next product decision, ask yourself:

Does this innovation solve a real problem or just look impressive?

Can we build this profitably within our cash runway?

Are we optimizing for market needs or engineering elegance?

The aviation industry will remember Lilium as a $1.5 billion lesson in the difference between brilliant engineering and successful business execution.

Which legacy will your company leave?

What else is interesting and new?

Google released Gemini CLI.

Perplexity Labs - Creating apps and visuals from research

State of Fundraising in Q1 2025: key findings from market reports

Databricks Acquires U.S. Serverless Database Developer Neon for $1 Billion

Danish Biotech Startup Cellugy Secures €8.1 Million to Eradicate Microplastics in Personal Care